Does the word “budget” conjure up images of complicated spreadsheets and tracking every last penny? Let’s be honest, retirement is your time to enjoy the fruits of your labor—to travel, to learn a new skill, or to simply spend precious time with family. It’s not the time to become a full-time accountant for your own finances.

The constant worry about due dates, fluctuating bills, and whether you can “afford” a spontaneous lunch with a friend can be draining. It’s a mental burden that chips away at the freedom you’ve worked so hard to achieve.

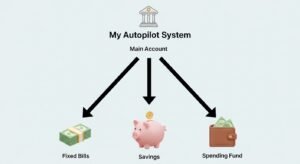

But what if there was a way to stay in complete control of your money while barely thinking about it? A system that ensures your bills are always paid on time, your savings continue to grow, and you know exactly how much you can spend guilt-free each month?

Welcome to the ‘Set It and Forget It’ budget—an elegant, simple system designed specifically for a stress-free retirement. In this guide, we’ll walk you through a few one-time steps to put your money on autopilot, giving you back your time and, more importantly, your peace of mind.

Table of Contents

1. Why This System is Perfect for Retirement

Before we dive into the “how,” let’s talk more about the “why.” A traditional, high-maintenance budget can feel like a second job. This automated system is different because it’s built on a foundation of simplicity, consistency, and automation—three pillars that are ideal for this stage of life.

- It frees up your mental energy. Financial decisions, big or small, cause “decision fatigue.” By automating the repetitive, essential decisions (like paying the electricity bill), you save your precious mental energy for things that truly matter—planning a trip, choosing a new hobby, or simply being present with your loved ones.

- It provides ultimate predictability. When you’re on a fixed income from pensions or Social Security, knowing exactly where your money is going provides incredible peace of mind. Your finances become like a calm, predictable river instead of a volatile ocean. No more end-of-month surprises or anxiety about whether you’ll have enough.

- It protects you effortlessly. A single missed payment can result in hefty late fees and a negative mark on your credit report, which can impact your ability to get favorable rates on future loans. Automation is a simple safety net that ensures your financial reputation remains spotless without you having to think about it.

- It simplifies life for you and your partner. Managing finances as a couple can be a source of stress. This system creates a clear, transparent plan that you both agree on. Furthermore, in the event one spouse has to manage the finances alone, this simple, automated system is infinitely easier to understand and maintain than a complex web of manual payments and spreadsheets.

2. The 4 Simple Steps to Build Your Autopilot System

Ready to build your own stress-free system? All it takes is a little bit of setup. Block out a single afternoon, put on some music, and let’s get it done.

Step 1: The ‘Know Your Numbers’ Financial Snapshot

You don’t need a fancy app for this. Just grab a pen, a piece of paper, and your recent bank or utility statements.

- Know Your Reliable Income: Write down every source of guaranteed income you receive each month (pension, Social Security, annuity payments, etc.). Add it all up to get your total monthly income. If you have variable income from investments, use a conservative, reliable average. This is your baseline.

- List Your Fixed ‘Autopilot’ Bills: Look at your bank statements and list all your predictable, recurring bills. These are your non-negotiable “must-pays.” Examples include:

- Rent or Mortgage

- Insurance Premiums (Health, Home, Auto)

- Utilities (use a 3-month average for electricity/gas)

- Phone & Internet Bills

- Car Payments or Leases

- Recurring Subscriptions (Netflix, Newspapers, etc.)

- Estimate Your Variable ‘Life’ Expenses: These are costs that change month to month. You don’t need to be perfect, just estimate a realistic weekly or monthly average for categories like groceries, gas for the car, dining out, and hobbies. This will help you in Step 3.

Step 2: Put Your Core Bills on Autopilot

This is where the magic happens. From your primary checking account (where your income is deposited), set up automatic payments for all the fixed bills you listed in Step 1. You can typically do this in one of two ways:

- Through Your Bank: Log into your bank’s website and use their “Bill Pay” feature. You can tell your bank to send a payment to the utility company on a specific date each month.

- Through the Service Provider: Log into your electricity provider’s or insurance company’s website and set up “autopay” using your bank account or credit card details.

Pro Tip – Pay Yourself First: While you’re setting up automation, treat your savings like the most important bill you have. Set up a small, automatic monthly transfer from your primary checking account to your savings account. Even $25 or $50 a month adds up and builds your emergency fund without you even noticing. It’s the most powerful wealth-building trick there is.

Step 3: Fund Your ‘Guilt-Free’ Spending Account

This is the secret to guilt-free spending and the absolute key to this system. The money left over after your automated bills and savings are taken care of is your flexible spending money for groceries, gas, coffee, gifts, and fun. Calculate this amount: `(Total Income) – (Total Autopilot Bills) – (Automated Savings) = Your Spending Fund`.

Set up an automatic transfer for this amount to move from your main account into a separate checking account with its own debit card. You can do this monthly, or if you prefer, divide the amount by two and transfer it every two weeks.

The rule is simple: if there’s money in this “spending” account, you can spend it on anything without a shred of worry, because you know with 100% certainty that all your important financial obligations are already covered.

Step 4: The Quick ‘Pilot’s Check-In’

“Forget it” doesn’t mean “ignore it forever.” Life changes, and so do expenses. Twice a year (say, in January and July), take 15-30 minutes to glance over your system with this quick checklist:

- Have any of my fixed bills changed (e.g., insurance premium increase)? Adjust the autopay amount if needed.

- Have I added any new subscriptions or cancelled old ones?

- Does my ‘Spending Fund’ amount still feel right? Or does it need a small adjustment?

- Can I increase my automated savings transfer, even by a little?

A quick check-in ensures your autopilot system stays perfectly aligned with your life.

Choosing the Right Tools: Bank Accounts for Success

This system works best with at least two checking accounts:

- The ‘Bills & Income’ Hub: This is your primary checking account. All your income (Social Security, pension) gets deposited here, and all your automated bills and savings transfers get paid out from here. Look for an account with no monthly fees or one where fees are waived for direct deposits.

- The ‘Spending’ Account: This is your day-to-day debit card account. For maximum psychological benefit, consider opening this at a completely different bank than your ‘Bills’ hub. This creates a powerful mental separation—when you look at this account’s balance, you’re only seeing your “safe-to-spend” money, which prevents you from accidentally dipping into your bill money.

Fine-Tuning Your System After Launch

After the first month or two, you might find your ‘Worry-Free’ spending amount needs a little tweak. If you consistently run out of money too early, you may need to look at your fixed bills and see if any can be reduced (e.g., call your cable company to negotiate a better rate). If you consistently have a lot of money left over, that’s great! It’s a perfect opportunity to increase your automated savings transfer and build your nest egg even faster.

3. Answering Your “What If…?” Questions

“What if I’m not good with technology?”

No problem at all. You can do this with one visit or a phone call to your local bank branch. Simply go in with your list of bills and say, “I’d like to set up automatic payments for these bills from my checking account.” They are trained to do this and will happily walk you through everything.

“What about expenses that change each month, like groceries or gas?”

That’s exactly what your ‘Worry-Free’ Spending Fund (Step 3) is for! That separate account with its own debit card is designed to handle all of life’s variable costs. The amount in that account is your budget for all these fluctuating expenses for the month.

“What if a big, unexpected expense comes up, like a car repair?”

This is why the automated transfer to your savings account (part of Step 2) is so important. That savings account becomes your emergency fund for life’s surprises. Building it slowly and steadily through automation means the money will be there when you need it, without causing a monthly panic.

“How do I handle large annual bills, like property taxes?”

This is a great question. For big, predictable bills that only come once or twice a year, create a separate, dedicated savings account labeled “Property Tax Fund.” Calculate the annual cost, divide by 12, and set up an automatic monthly transfer for that small amount into this dedicated account. When the bill arrives, the money will be sitting there waiting for it.

Your Retirement is for Living, Not Budgeting

Your retirement years are precious. They are a reward for a lifetime of hard work. By investing a single afternoon to set up this automated system, you are buying yourself countless hours of future peace of mind. You’re taking the mental chore of money management off your plate so you can free up your mind and your time to focus on what really matters.

This isn’t about restriction; it’s about liberation. It’s about designing a system that serves you, so you can stop serving it. So, why not take the first, tiny step today? Just grab a piece of paper and complete Step 1. You’re only 30 minutes away from a more relaxing financial future.

*You Might Also Like Smart Money-Saving Tips for Retirees